What we can learn from Europe, China, and California

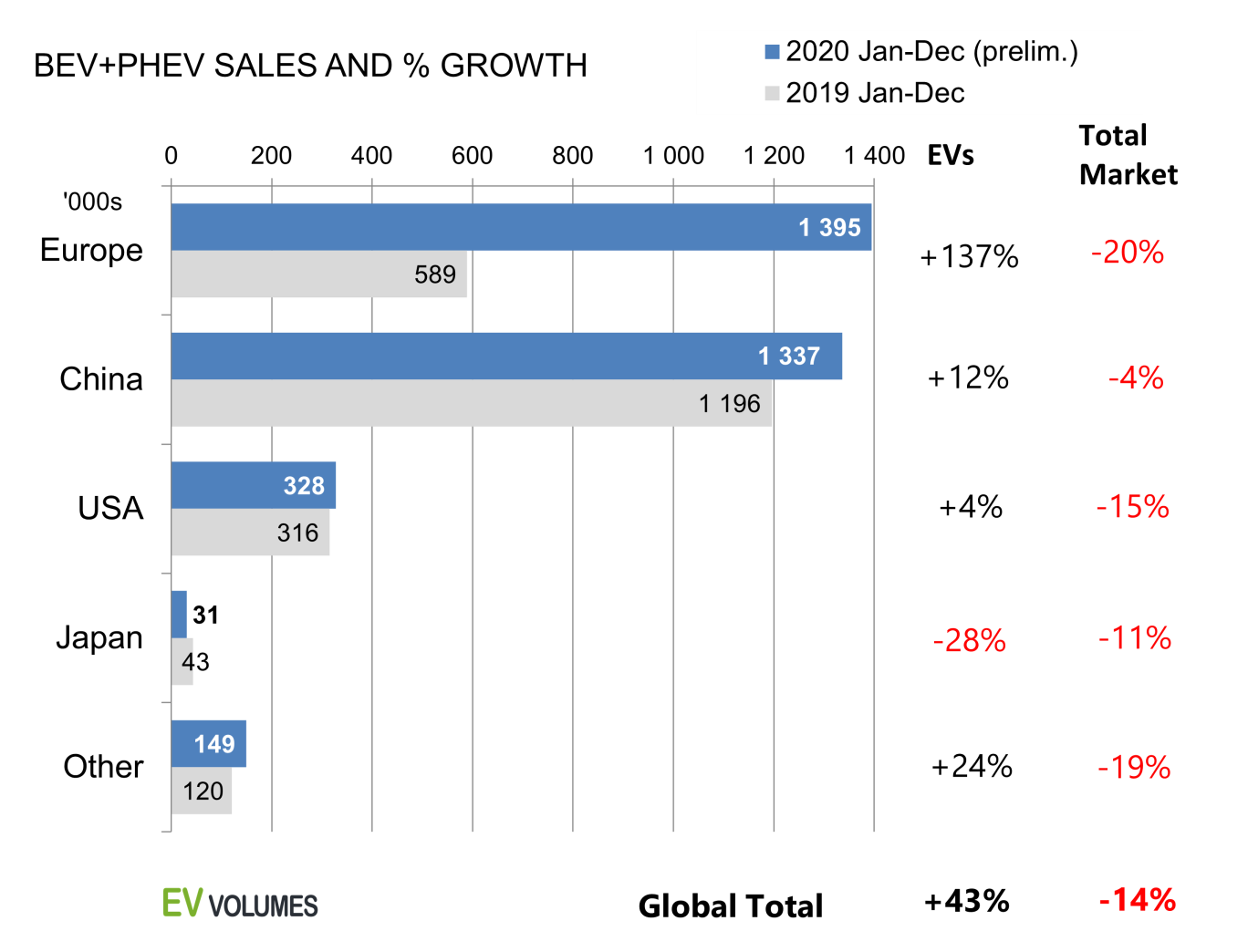

2020 was a great year for electric vehicles (EVs). Around 3.24 million EVs were sold world-wide. In the US, we had gains in the number of vehicles sold, but we still only account for slightly more than 2% of total EV sales in the last year. In fact, most of the world’s 2020 EV sales were in Europe and China.

In Europe, 1.36 million EVs were registered last year, despite the overall auto industry’s slump at the beginning of 2020. This accounts for 42% of total global EV sales for that year. And it’s looking like new electric car sales in Europe are already set to beat their previous record, with some reporting upwards of 400,000 electric vehicles registered in just the first 3 months of 2021.

In China, another 1.3 million EVs were sold in 2020 (accounting for 41%of global sales), and 2021 is looking to be even more promising, with some projecting that EV sales will grow by another 50% in 2021.

In the United States, however, the outlook is very different. In 2020, the total sales of EVs (both completely electric, and plug-in hybrids) only amounted to 328,000 (up over 316,000 in 2019). But all is not lost. California alone sold just over 144,000 EVs and hybrids in 2020, nearly 44% of all EV sales in the US.

So while EV sales in the US are picking up, we’re still lagging behind Europe and China. Why?

Part of what is driving this are the generous tax breaks and subsidies on electric vehicles, making EV’s financially attractive. China also has a subsidy on electric vehicles, as does the US, but China’s are range-based, rather than based on battery capacity (as it is in the US). China’s range-based system essentially promotes small, powerful EVs, a smart move in a country with a premium on space.

In the EU, all but one country offers some kind of stimulus to buy an electric vehicle – either all-electric or hybrid. 20 of those countries offer up a bonus payment, as opposed to just a tax break- making buying EVs a very attractive choice. In fact, the French government released a plan last year to provide up to $13,000 to incentivize buying EVs and hybrids. In Norway, where EVs outsold gas cars in 2020, they have adopted the “polluter pays” principle, making taxes on large gas-guzzling vehicles much higher than small, low- and no-emissions cars. This, along with a combination of other tax breaks in a country with some of the highest taxes on cars, has led Norway to become the poster child for EV sales.

China has also had subsidies for electric cars for several years, but as the production and sale of electric cars picks up, they have begun to phase this out. It’s worth noting, however, that their earlier phase out of EV subsidies (combined with the pandemic) resulted in a slow-down of EV sales. So here too one can see the impact of subsidies.

In the US, the federal tax credit can be up to $7,500, with some caveats.

In addition to the federal tax credit, individual states offer their own incentives. California, for example, offers a $7,000 rebate to purchase any kind of EV (hybrid, battery, or fuel cell). They also offer a combination of other incentives, including city and state tax breaks, as well as assistance from utility companies for chargers. Once again California shows its leadership in encouraging the adoption of sustainable transportation solutions and has one of the highest percentages of EVs on the road, with 47% of all EVs in the US.

But it doesn’t all boil down to tax breaks and rebates.

In a 2020 survey, just over 70% of Americans responded that they were interested in buying an electric vehicle. However, 50% of the respondents cited ‘not enough public charging stations’ as what most concerned them about buying an electric car.

In a country where it’s not unusual to have an hour-long commute (one-way), this is a valid concern. We also have long stretches of highway without gas stations, let alone EV charging stations. According to the Department of Energy, the US has only 41,400 public EV charging stations. Most of those are in California (32,509), where most of the US’s EVs are.

In contrast, Europe and the UK have 250,000 charging stations, with plans to expand to more than 1 million by 2025. Norway has implemented a program to install two fast-charging stations for every 50 km of main road (they now have 16,000 public charging points). China installed more than 284,000 public charging stations in 2020, bringing China’s total number of public charging stations to 800,000.

We obviously need to up our game in regards to EV infrastructure.

To that end, the current White House administration has a plan to build a network of 500,000 more charging stations by 2030. They plan to deploy a mix of chargers in apartments, main roads, and in public parking areas. This could be a big help in pulling us closer to Europe and China’s explosive EV sales.

In addition, California has accelerated its plans for EV infrastructure in recent years, with the Department of General Services installing over 1,800 EV chargers in state facilities, and 1,200 more on their way. California utility companies are also piloting programs to install more chargers in apartments and businesses, and the California Public Utilities Commission (CPUC) has authorized the use of millions of dollars to implement more charging stations.

Private sector companies are doing their part as well. Connecticut-based JuiceBar has deployed charging stations in more than 100 cities in the US and Canada, bringing us that much closer to a national EV charging infrastructure.

In short, for the US to catch up to Europe and China, we need to make buying EVs more attractive. We desperately need to improve our national EV charging infrastructure, and we need to make buying electric cars the smart financial choice.

Europe and China are doing it… So can we, with California leading the way with smart incentives and scaled up EV Charge infrastructure.

Written by Blaise Epstein, A former teacher from Los Angeles, currently a writer in Seattle, Washington.